Understanding the Basics of Income Tax in India

Income Tax is a direct tax that every citizen of India is liable to pay. It is a primary revenue source for the Government of India and State Governments to fund welfare initiatives. Therefore, it becomes crucial for every earning individual to ensure compliance with tax payments, optimize their financial planning, and be part of the nation-building process. This article aims to give the basic concept of income tax in India, outlining its importance, structure, and key elements.

What is Income Tax?

Income tax is a direct tax levied by the government on the income earned by the citizens of India and foreign nationals on the income earned within the borders of India. It is a legal and financial obligation in India. All individuals earning above a certain threshold of income are required to pay income tax on their income.

The income tax rules, rates, and slabs are decided and regulated by the Government of India and are subject to change from time to time. However, it is the responsibility of all taxpayers to accurately report their income taxes and file returns on time. Failure to file returns or pay tax can result in penalties and fines.

Why is Income Tax Collected?

Income tax is a fundamental mechanism through which governments secure the resources needed to function effectively, provide public services, ensure social equity, and maintain economic stability. Here are some of the key reasons why Income tax is key to the functioning of government.

- Income tax is used to fund essential public services such as education, healthcare, defence, public safety, infrastructure, and social welfare programs.

- It covers the administrative and operational costs of running government institutions and agencies.

- It ensures a more equitable distribution of resources, promoting social stability and cohesion.

- Income taxes are invested in infrastructure projects like roads, bridges, public transit, and utilities, essential for economic growth and quality of life.

- It helps in funding programs aimed at alleviating poverty and supporting vulnerable populations.

- Income tax helps maintain the rule of law by providing the necessary funds to enforce regulations, uphold justice, and ensure compliance with laws.

Income Tax Structure in India

The income tax structure in India is governed by the Income Tax Act, 1961. It outlines the framework for tax calculation, collection, and compliance for individuals, HUFs (Hindu Undivided Families), firms, companies, and other entities. It also has laid out laws for tax calculation, collection, and compliance.

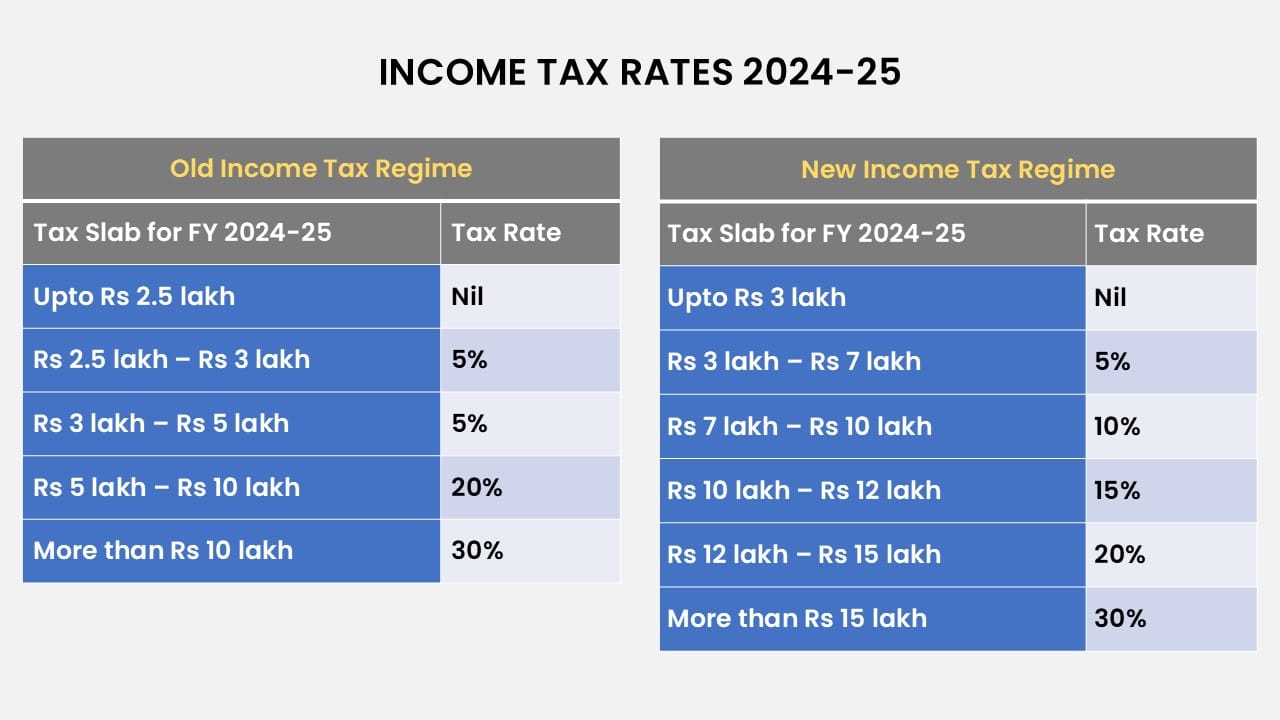

India follows a progressive tax system, meaning the tax rate increases with the rise in income. The income tax structure is categorized into different slabs, with varying rates for income. There are also two different regimes for Income Tax in India.

- Old Regime

- New Regime

Old Regime

The old Income tax regime provides several deductions and exemptions and can significantly reduce the taxable income. Some of the key deductions include:

- Section 80C: Deductions up to Rs 1,50,000 for investments in instruments like PPF, EPF, NSC, and life insurance premiums.

- Section 80D: Deductions for medical insurance premiums, up to Rs 25,000 for individuals and Rs 50,000 for senior citizens.

- Section 24: Deductions on home loan interest, up to Rs 2,00,000 for self-occupied properties.

New Regime

The New Income tax regime offers simplified tax slabs with lower rates but eliminates most deductions and exemptions. It is designed to provide ease of compliance and lower tax rates for those who do not have significant investments or expenses eligible for deductions.

The Government of India introduced the New Income Tax Regime in the Union Budget 2020, offering lower tax rates, more slabs, and without most deductions and exemptions. Taxpayers can choose between the two based on their financial situation and preferences.

Old Regime vs New Regime

Both Income tax regimes benefit taxpayers depending on their income, types and age of investments, and multiple factors. Here’s a comparison of tax slabs and rates in the Old and New Tax Regimes.

Types of Income Tax

Income tax in India is classified based on the nature of income:

- Income from Salary: Earnings from employment, including basic pay, allowances, and perquisites.

- Income from House Property: Rental income from owned property.

- Income from Business or Profession: Profits from business or professional practices.

- Income from Capital Gains: Earnings from the sale of capital assets like property, stocks, or mutual funds.

- Income from Other Sources: Residual income such as interest, dividends, or winnings from lotteries.

Choosing Between Old and New Regime

Choosing the right tax regime depends on your financial situation like sources of income, types of investments, and more. If you have significant deductions and investments, the old regime may be more beneficial. However, if you prefer lower tax rates and simplified compliance, the new regime could be advantageous. Here’s a comparative analysis:

Old Regime

Pros

- Allows for various deductions and exemptions.

- Beneficial for taxpayers with high investments in eligible schemes.

Cons

- Higher tax rates compared to the new regime.

- Requires meticulous record-keeping and documentation for claiming deductions.

New Regime

Pros

- Lower tax rates.

- Simplified tax calculation and filing process.

Cons

- Does not allow for most deductions and exemptions.

- May not be beneficial for taxpayers with significant eligible investments.

Income Tax Returns (ITR)

Income Tax Return (ITR) is an annual filing of income details to the Income Tax Department, Ministry of Finance, GoI. Every taxpayer should report their income, expenses, deductions, investments, and taxes paid. It is a mandated activity for all individuals who earn income above a certain threshold.

The ITR form includes details of income from various sources such as salary, business profits, property rental, capital gains, and other sources. It also accounts for tax-saving investments and deductions under various sections of the Income Tax Act, which help reduce taxable income. After assessing the total tax liability, if the taxpayer has paid more tax than what is due, they can claim a refund; if less, they need to pay the balance.

Filing an ITR is important as it serves as proof of income, is required for processing loans, visa applications, and other financial matters, and ensures compliance with tax laws, avoiding penalties and legal issues.

Filing ITR (Income Tax Return)

Filing on Income Tax Returns (ITR) must be done on or before 31st July of every year for the previous financial year (Assessment Year). ITR Returns be filed in both online and offline modes. While online filing is the most recommended process for simplified filing, offline filing requires the support of a certified chartered accountant (CA). Offline mode is preferred by taxpayers with high incomes and diversified investments and liabilities.

How is Income Tax Paid to the Government of India?

Income tax in India is paid to the government through three primary methods:

- Tax Collected at Source (TCS)

- Tax Deducted at Source (TDS)

- Self-Assessment Tax

Here’s how each works:

Tax Collected at Source (TCS)

Certain sellers collect tax at the source itself when specific transactions occur. For example, when you purchase goods like alcohol, tendu leaves, or minerals, the seller collects tax at a specified rate. This TCS is then deposited with the government on your behalf. The amount collected is later reflected in your tax credit statement (Form 26AS) and can be adjusted against your total tax liability.

Tax Deducted at Source (TDS)

TDS is a method where tax is deducted directly from your income by the payer before it reaches you. Common examples include salary, interest from banks, rent, and professional fees. The deducted amount is then deposited with the government, and you receive the net amount. The deducted tax is reflected in Form 26AS while filing annual returns and helps reduce your overall tax liability.

Self-Assessment

After accounting for TDS and TCS, if any additional tax liability remains, it must be paid by the taxpayer through self-assessment. This is typically done while filing your income tax return. Self-assessment tax ensures that the taxpayer has paid the full amount of tax due for the financial year.

These methods ensure the efficient collection of income tax in India.

Conclusion

Understanding income tax is essential for every earning individual. It not only ensures compliance with legal obligations but also helps in effective financial planning and tax optimization. By leveraging the available deductions and exemptions, taxpayers can significantly reduce their tax liabilities.

Frequently Asked Questions (FAQs)

An Income Tax Return (ITR) is a form filed with the Income Tax Department to report your annual income, deductions, and tax payments. It is used to calculate your tax liability and claim refunds if you’ve paid more tax than required.

The Income Tax Department offers different ITR forms depending on your source of income:

- ITR-1: For individuals with income from salary, one house property, and other sources like interest.

- ITR-2: For individuals with income from capital gains, more than one house property, or foreign assets.

- ITR-3: For individuals and HUFs having income from a business or profession.

- ITR-4: For individuals, HUFs, and firms under presumptive taxation.

Filing ITR after the due date can result in a late fee under Section 234F, interest on any unpaid tax, and loss of certain deductions. Additionally, you may miss the opportunity to carry forward losses to future years.

Yes, if you discover an error in your ITR after submission, you can file a revised return before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier. This allows you to correct any mistakes or omissions.